LIQUIDITY MANAGEMENT IN THE SLOVAK STATE TREASURY SYSTEM

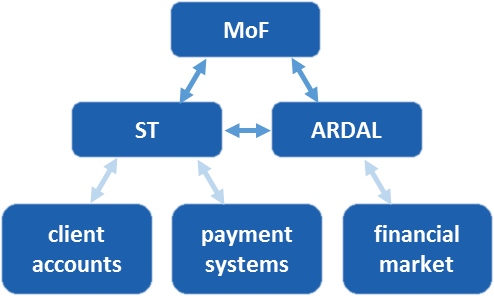

The State Treasury System, consisting of the Ministry of Finance of the Slovak Republic (MoF), the State Treasury (ST) and the Debt and Liquidity Management Agency (ARDAL), was created by the Act on the State Treasury(1). In the State Treasury System, the Ministry of Finance acts as a body that defines the process and framework and acts as the organizer and system administrator. The main task of the State Treasury is to maintain the accounts of government and public sector clients and is responsible for the processing of payments. ARDAL is responsible for debt and liquidity management activities, including market and other related risk management. The administration and operation of State Treasury information systems, including their technical and operational support, is provided by a specialized institution-DataCentrum.

The liquidity management of the State Treasury is one of the main activities provided by the State Treasury System. The liquidity of the State Treasury means the ability of the State Treasury to pay the obligations arising out of the Treasury system properly and in a timely manner. Liquidity Management of the State Treasury is a complex activity designed to effectively and safely ensure the liquidity of the State Treasury. The main tasks of managing the liquidity of the State Treasury are to ensure liquidity (coverage) of the state budget and liquidity (repayment) of sovereign debt.

State Treasury System entities and their relationship in liquidity management of the State Treasury:

Changes in debt and liquidity management of the state after the establishment of the Treasury system in 2003 can be considered revolutionary. In 2004, the accounts of the Ministry of Finance together with the accounts of all budgetary organizations were transferred from the National Bank of Slovakia to the State Treasury. Similarly, all accounts of public institutions (except of cities, municipalities and regional government accounts) were at the same time transferred from the commercial banks to the State Treasury. This concentration of financial resources in the State Treasury allowed the usage of public sector clients' temporarily available funds for debt and liquidity management purposes via the newly designed and implemented refinancing system. Subsequently the regional governments were also included in the State Treasury System. Financial funds of cities and municipalities are still not included in the State Treasury System.

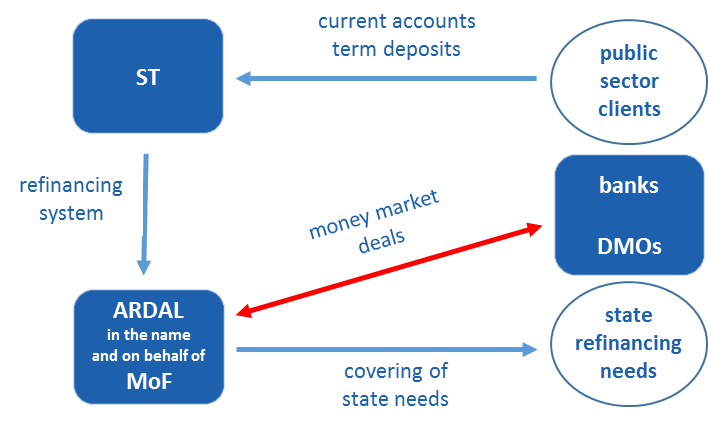

Basic idea of the State Treasury System:

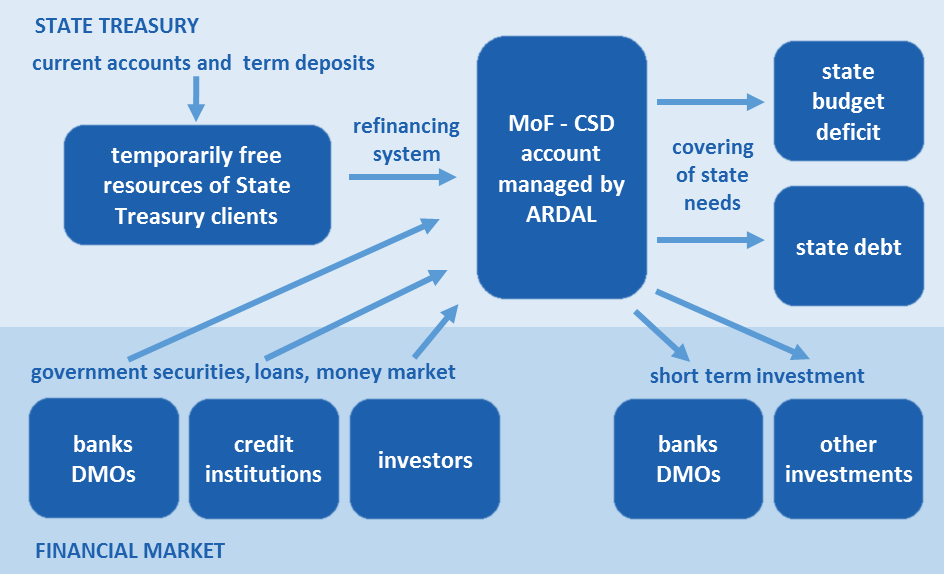

REFINANCING SYSTEM

The refinancing system is realized in the form of deposit deals between the State Treasury and the Ministry of Finance of the Slovak Republic-Client State Debt (MoF-CSD)(2). Technically the refinancing system is realized in two separate phases. In the first phase all term deposits of the State Treasury clients with the State Treasury are transferred to the MoF-CSD under the same conditions as the original deals between the State Treasury and it's clients. The second phase is realized shortly before the end of the day procedures of the State Treasury information system. The account of the MoF-CSD is automatically credited by overnight deposit transactions in amount equal to the current accounts balance of the State Treasury clients. This one-day deal is realized under current market conditions (EONIA adjusted by the agreed spread).

The entire position of the State Treasury-the sum of individual balances on clients' accounts, including market risks-is transferred to the MoF-CSD. Through the refinancing system, the Ministry of Finance receives a considerable amount of short-term resources, which can be used to cover the needs of the state deficit and debt. The fact that it is 10-20% of the total debt portfolio significantly reduces the need for short-term securities issues. The costs of these resources are usually lower than at the financial market. The government cash reserve may not consist of issued government securities or loans, as it is in countries where the State Treasury System is not implemented. Except the financial savings, the system reduces the risk of refinancing the state at times of market failures or ongoing crises. In the case of a sudden rise in short-term interest rates, the system brings cost savings through the coverage of the state budget deficit.

The system is designed so that at any moment every single euro in the State Treasury System covers the state's deficit and debt, or is invested in the financial market or elsewhere. The system brings maximum transparency of the state's financial flows, especially for the Ministry of Finance, allowing simple control and information availability. At the same time, the system has streamlined financial planning and simplified the preparation of the state debt budget.

OPERATIONAL MANAGEMENT OF THE STATE TREASURY LIQUIDITY

In accordance with the provisions of the State Treasury Act, ARDAL is responsible for the operational liquidity management of the State Treasury account in Target2 on a daily basis. The cash flows of this account reflect all government budget flows, flows related to debt and risk management as well as State Treasury client flows. ARDAL uses standard money market instruments for the purposes of liquidity management of the State Treasury, in particular deposit deals, repurchase transactions, sales and buy-backs of government bonds and currency swaps. ARDAL executes all these transactions in the name and on behalf of the MoF-CSD.

The State Treasury realizes the payment of funds resulting from ARDAL's liquidity management operations. The State Treasury is a direct participant in the Target2 European real-time gross settlement system as well as the local payment system (SIPS). ARDAL has the ability to monitor balances and movements in these accounts in real time.

The State Treasury provides ARDAL with a daily State Treasury financial plan for the next three months ARDAL cooperates with the State Treasury to determine it's structure and content. The overview for the next three months includes the expected cash flow of State Treasury clients as well as data from ARDAL's main trading system on financial flows of transactions (which ARDAL performed on behalf of MF SR-CSD in the past). ARDAL considers the three-month horizon as sufficient for operational liquidity management.

Cash flows of the State Treasury System:

The state liquidity management system as a part of the State Treasury System was designed and implemented between 2003 and 2004. It is still working well with minimal changes and modifications. The State Treasury System, liquidity management and the refinancing system are unique within Europe and meet the conditions and needs of public finance management in Slovakia.

-----------------------------------------------------------------------------------------------------------------------------

(1) Act No. 291/2002 Coll. on State Treasury and on amendments and supplements to certain laws as amended

(2) Client State Debt (CSD) is a special client of the State Treasury for activities related to sovereign debt according to § 2b 1 k) of the Act on State Treasury. CSD in the State Treasury System is represented by ARDAL.

The financial operations performed through the CSD account relate to the financing of the state budget deficit, state debt financing, risk management, and the investment of temporarily uncommitted funds. ARDAL also performs financial operations on the CSD account to ensure the liquidity of the State Treasury.

The financial operations of the CSD are logged in a separate account headed "State Debt" within the accounting unit MoF in the budget chapter „General Treasury Administration".